Investment, Ardan Wealth Platform

8 Key Reasons to consider Ardan Wealth Platform

Are you looking for the right investment platform to grow wealth and gain passive income?

Passive Income Investment can be quite handy if you are looking to achieve Financial Independence and Well-being.

Instead of waiting to receive an income at retirement, it is wise to invest in assets that can supplement your salary/profits.

Any income received as a salary, profit, fees, gambling or from any other activity involving time and effort is Earned income or Active income.

It is generated when you are at work.

It stops once you stop working or worse if you are unable to work due to health reasons

Earned income is directly proportional to the amount of time you spend at work and the skills you develop.

It is also difficult to increase earned income without working longer hours or acquiring a new skill/knowledge.

In spite of these challenges, a majority of the earning population largely depends on active income, as it does not involve an injection of capital.

In spite of these challenges, a majority of the earning population largely depends on active income, as it does not involve an injection of capital.

Portfolio income is any income generated by selling an investment at a higher price than you initially paid for it; plus the costs involved in maintaining the asset in resalable quality.

For example: If a salaried executive purchased a property for AED 1,000,000 and paid an amount of AED 50,000 towards maintenance, registration charges, mortgage fees and interest before he sold the property in 3 months for AED 1,100,000; his portfolio income from this transaction would be AED 50,000/-

It is usually generated by the trading of assets invested for the purpose of selling for profit in future. Some examples of portfolio income in UAE are;

Pursuing Portfolio income includes the following challenges;

In spite of the above-mentioned challenges, portfolio income has a definite advantage over earned income.

It allows you to benefit from the Power of compounding when investing for the medium to long term.

Once you have gained adequate knowledge and experience in trading paper and tangible assets on a consistent basis, it can help you enhance your financial well-being much faster.

Such income can catapult your wealth to a large extent.

Regular cash flow generated from activities that require little or no effort is called passive income.

It is usually cash flow generated from assets owned or controlled by an individual.

The following are some of the passive income ideas in UAE;

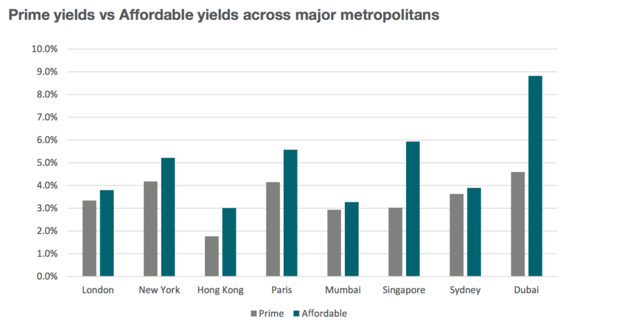

The falling property prices and the surge in affordable housing in UAE have pushed the rental yields up. It would be wise to invest in a rent-yielding property in Dubai.

The following chart from the Affordable Housing report by Core Savills; substantiates the fact that rental yield in Dubai is far better than its counterparts;

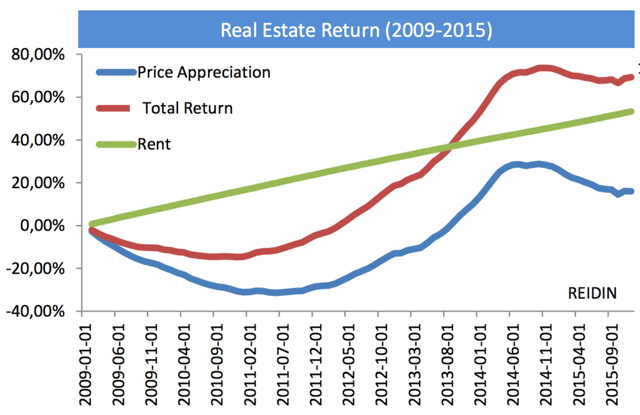

Also, the following chart from http://blog.reidin.com/ emphasizes the importance of investing for income vs investing for capital gains;

Also, the following chart from http://blog.reidin.com/ emphasizes the importance of investing for income vs investing for capital gains;

According to the report, the return from rental income had outpaced the income from capital appreciation between the years 2009 to 2015 and the trend is likely to be better, given the falling real estate prices in UAE.

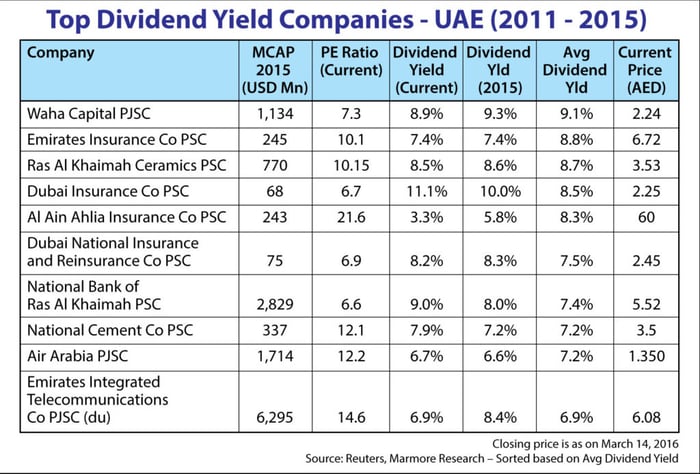

Dividend from stocks (DFM, ADX or international) is a good source of cash flow.

The following chart shows the average dividend yield from UAE stocks from 2011 to 2015.

There are some major benefits to passive income over the other two types of income:

Given these above benefits, many expats are now keen to build a portfolio of assets generating passive income. However, they face the following challenges;

Accumulating capital for investing in assets generating passive income is the first and the most important step. You need to have a critical mass in the form of investable capital to generate sufficient passive income.

Accumulating capital for investing in assets generating passive income is the first and the most important step. You need to have a critical mass in the form of investable capital to generate sufficient passive income.

As simple as it seems, the most efficient strategy of capital accumulation is saving from your active income.

As rightly stated by Robert Kiyosaki;

"The key to financial freedom and great wealth is a person's ability or skill to convert earned income into passive income and/or portfolio income.”

To know how to effectively accumulate capital and set up a robust passive income generation strategy, feel free to arrange a Free Initial Consultation with me.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

%20(350%20%C3%97%20250%20px)-2.png?width=300&name=Ardan%20Wealth%20Platform%20(700%20%C3%97%20350%20px)%20(350%20%C3%97%20250%20px)-2.png)

Are you looking for the right investment platform to grow wealth and gain passive income?

%20(350%20%C3%97%20250%20px).png?width=300&name=income%20%E2%89%A0%20Wealth%20(700%20%C3%97%20400%20px)%20(350%20%C3%97%20250%20px).png)

The UAE is a land of opportunity providing residents with a relatively higher disposable income.

I have read quite a few books if not many; on the...