7 reasons to buy life insurance in the UAE

Are you wondering if you should buy Life Insurance in the UAE?

Imagine a life insurance that does much more than just paying out a cash lumpsum on death!

What if it also acted as a reliable income replacement tool, or even as a savvy addition to your retirement savings?

That's right, life insurance isn't just about providing a safety net; it can be a versatile financial tool enhancing your life in multiple ways.

Looking for life insurance that gives you more?

Then, you're in the right place!

In UAE there are there are many choices, but Zurich Futura is different.

It is a comprehensive and flexible - Whole of Life plan designed to fit seamlessly into your life and financial plans.

Want to see how Zurich Futura can do more for you?

Futura is a Flexible, whole-life insurance policy providing life cover, living benefits, and cash surrender value to complement your retirement savings.

Now, you might be wondering, 'Is Zurich Futura the right choice for me?' or 'Does it really live up to the hype?' It's a great question, and the answer isn't a simple yes or no. It all comes down to your individual needs, age, and budget.

Here is an unbiased review of Zurich Futura Life Insurance.

Please read this and click here to connect with me for a personalised assessment of your protection needs and select the right policy for you among the various providers and plans.

It is Flexible

Click here to read how It can adapt to changes in your life.

Although Term Insurance is the simplest and most affordable type of life insurance policy, it is only ideal for cover terms less than 25 years.

If you are looking for a cover term longer than 25 years, then a Futura would be more suitable and economical.

Futura is primarily designed to pay a cash lump sum on death. It also has an array of additional living benefits, also known as riders.

They payout in case you are unable to earn due to severe illness, accident, disability, or hospitalization.

These riders are optional; Add them for a small extra cost, and you boost your cover, making sure you're protected in more ways than one.

Futura is here to offer you not just insurance, but a comprehensive safety net tailored to your life."

Zurich Futura is designed to provide life insurance and access to a wide range of Investment funds to help you Grow Wealth and Protect against Loss of Income. It also allows partial or full encashment at any time.

In simple words, It is the Best Whole of Life Insurance with an investment option aiming to provide maximum benefits at a minimum premium.

The Investment aspect and strategy of Zurich Futura play a significant role in determining and maintaining the level of your benefits(Life Insurance, Critical Illness Insurance, etc.) on the plan.

Effectively managing your plan's fund performance is key to the sustainability of your plan for the “Whole of Life”.

Click here to learn how to improve your policy's fund performance.

As a Financial Adviser, I have met many people in Dubai who have been sold a Zurich Futura by a tricky banker or a sneaky financial advisor as an investment plan or a guaranteed whole-of-life insurance plan.

They were shocked to find out that it was not what they believed the policy to be!

It is very critical that you read and understand the terms and conditions of any insurance or investment plan before signing on the dotted line, no matter how trustworthy your financial advisor or banker is.

Click here to view the terms and conditions of Futura UAE

Zurich Futura UAE provides protection, even if you move permanently to another country.

Zurich Futura UAE provides protection, even if you move permanently to another country.

As Expats, our primary concern, and sometimes the only concern, while availing insurance or investment in UAE is whether the particular plan will continue to provide the benefits if we move out of UAE for good.

The Futura aims to continue to provide protection, even if you move permanently to another country.

The portability is subject to exclusions based on your travel, residency history, and your plans at the time of availing of the policy.

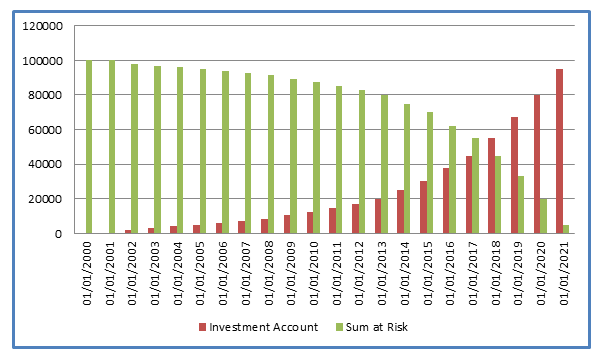

Zurich Futura works on a Sum at Risk basis.

This means that the insurance premium is charged on the difference between the sum assured and the account value on a particular date.

For E.g., If John had signed up for a Futura in 2001 of $ 100,000 life cover. His current balance in the investment account is $20,000, then his premiums will be charged on $80,000, even though the sum assured is $100,000/-

The sum at Risk is the difference between the actual sum assured and the value of funds in the investment account.

The sum at Risk is the difference between the actual sum assured and the value of funds in the investment account.

In UAE, all residents over 18 years of age can apply for a Futura.

Even companies or Trusts can avail a Futura on the lives of its employees, directors, partners, and trustees.

You can avail of this plan on Single Life, Joint Life First Death, Joint Life Both Death or on Joint Life Last Death Basis.

Futura in UAE includes 36 Critical Illnesses, including children's critical illnesses benefit.

This benefit provides a cash lump sum amount if you are diagnosed with a critical illness or undergo a medical procedure covered under this policy.

A waiting period of 90 days from the start of the policy is applicable.

Payment of a critical illness claim will reduce the life cover amount for the relevant life insured by the claim.

Click here to view the Critical Illness list and details of Zurich Futura

A series of regular payments are paid in the event of the death of the insured. The term of family-income benefit can be up to 40 years from the inception of the policy.

Click here to learn more about the Family Income Benefit

A series of regular payments are paid in the event of the death of the insured. The term of family-income benefit can be up to 40 years from the time of a death claim.

Click here to learn more about the Fixed Term Income Benefit

Is paid in addition to the life cover, where the life insured dies as a result of an accident.

Is payable if the life insured is hospitalized for more than three consecutive days. This benefit is valid up to the age of 70.

Pays a lump sum if the life insured loses sight or limb as the result of an accident.

Pays a lump sum amount if the life insured is diagnosed as permanently and totally disabled.

Zurich will waive your premiums if you are unable to work through accident or illness.

Is paid if the life insured dies as a fare-paying passenger on a commercial airline. This benefit is provided free of charge.

Click here to know the top 5 reasons why I use Zurich Futura.

Call me at +97150-2285405 or arrange a Free Initial meeting with me to discuss your protection needs and solutions.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

.png?width=300&name=reasons%20to%20buy%20life%20insurance%20in%20the%20UAE%20(350%20%C3%97%20250%20px).png)

Are you wondering if you should buy Life Insurance in the UAE?

Zurich Futura: A Premier Whole Life Insurance in the UAE